The Numbers to Becoming a Millionaire

Understanding Personal Finance: What it takes to save $1,000,000

There’s

something about having $1,000,000 that garners people’s

attention — like a magnet, that big round number can’t help but attract

your eyes. It’s a number that people associate with having wealth.

Something about turning 6 digits in an account into 7 captivates the

American population; it’s a far away goal that is just close enough that

many people inadvertently strive to reach that number.

Which

makes sense, being a millionaire is quite a common occurrence. About 11

million Americans are considered millionaires, sounds crazy high right?

Compared to the population of the US (325 million) that’s about 3.4% of

the American population. In some areas it’s more extreme, 13% of New York City’s population are millionaires, the highest concentration of “High Net Worth” individuals in the world.

That’s

11 million people that have reached the $1,000.000 goal. So how far

fetch could something be if 11 million people have achieved it? Which

starts to indicate that even you can save $1,000,000. That you don’t

necessarily have to be a person with a large salary where money rains

every time they make a decision. The numbers to reach a $1,000,000

aren’t as out of reach as people imagine. This is especially relevant

the younger you are, someone in their 20s should be doing their best to

make saving $1,000,000 possible for them.

What it takes to save $1,000,000

The

most powerful tool you can have when saving is compound interest. It’s

the classic protagonist that gets more powerful with time and small

power-ups, where even a 1% change in percentages over a long period can

have a profound effect. Whenever you talk to an investor, the % of

returns they make on their investments is almost always the most

important aspect they talk about.

The Gold Standard of Investing

The

gauge that most people use for a standard return on an investment is

the S&P 500. The S&P 500 is made up of 505 (ironic that it isn’t

500) of some of the largest companies in the world that are bundled

together for people to use as a market index, which is a measure on a

section of the stock market. For most investors, one of the best things

you can do is to invest in an S&P 500 index fund, which is a fund

that matches the S&P 500. Over the last 90 years, the S&P 500

has returned, on average, 9.8% of compounded interest every year.

Give me some of that compound interest

Imagine

this, you put $100 in an S&P 500 index fund, and you leave it there

for 10 years. With simple interest, you would only receive interest on

your principal deposit, which is the initial amount of money you put in,

so you get $9.80 every year on your deposit. So after 10 years, you

would have a whopping $198, not bad right?

But,

compound interest is even more powerful! The beauty is that it allows

you to earn interest on the money you’ve earned too, not just your

deposit.

So

in your first year, you would earn the same $9.80, but in your second

year, you would earn 9.8% not just on your $100, but on $109.80. This

gives you a whopping $10.76, keep doing this calculation for 10 years,

and the amplification effects get you to $255. $57 more than simple

interest.

Still,

$255 is a far cry to $1 million so what does it actually take? To

simplify this calculation, we’re going to assume the specific interest

rate of 9.8%. In reality, this rate may be a little bit lower with

management fees and some diversification in bonds, but I feel that

showing how mighty S&P 500 returns are is an essential teaching. How

I’ll solve for a million dollars will be based on how much money you

need to save every day with time frames of 5, 10, 20, 30, 40, and 50

years. I like using the daily time frame as it allows people to gauge

their everyday spending.

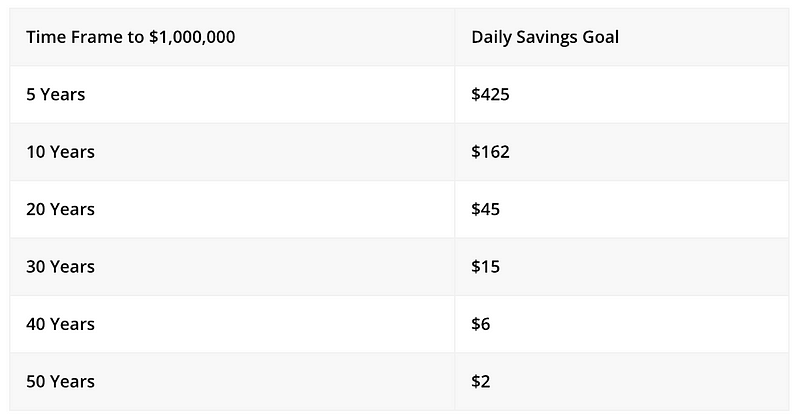

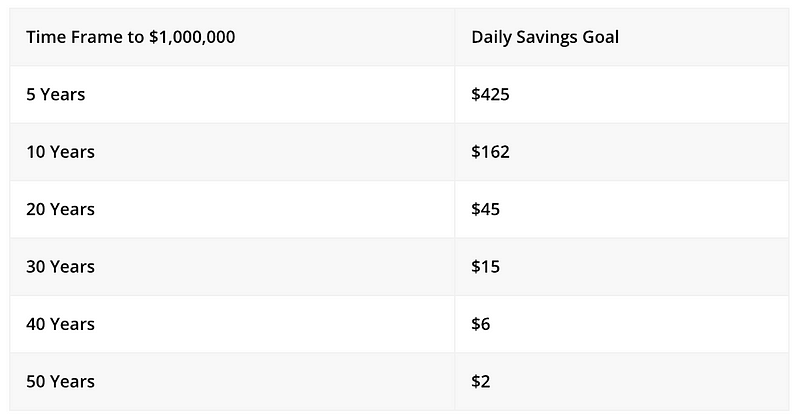

Amount of daily savings it takes to save $1,000,000 at a 9.8% compound interest rate:

If

you want $1 million in the near future, it will take a bit of money.

Pointing to the fact, that it is important to start saving for

retirement or any savings goal as soon as possible.

The

more time you have to save for any goal, the more you can utilize the

power of compound interest and decrease the burden on your day to day

personal finances.

$424

a day is a lot if you want to save a million in 5 years, but just

doubling your timespan to 10 years reduces the amount you need to save

to almost 1/3rd of the 5-year time frame. Give it even more time, and

the numbers start looking manageable.

For me, $15 a day is giving up my lunch here in NYC and packing my own,

and $6 is the coffee and scone I always buy at the corner of my office

(Yes, i know those prices are obnoxious, but restaurants have to pay for

$20,000 NYC rent somehow).

$2 a day for 50 years

I

wasn’t lying when I said compound interest gets more powerful with

time. It’s so powerful that if your 20 right now and start saving JUST

$2 a day, by the time you’re 70 it’ll reach $1 million. There are other

aspects to think about, inflation is the most important, but if your

goal is to just achieve that 7 digit number we can think of it this way.

Of course, the S&P 500 may not return at a 9.8% rate over the next

50 years, but even adjusting for an 8% return, $4 a day would get you to

$1 million. Who knows, maybe it’ll return even more than 9.8% a year.

Unfortunately, I can’t predict the future.

Ask

yourself, what does this money mean to you right now? To me $2 is as

simple as just automatically saving $14 a week from each paycheck, i

know some people have it rough, but I honestly do think that finding $2 a

day is a doable endeavor for those with the gift of time. The best part

is with these denominations of money your interest could be tax-free by

putting money in a ROTH IRA, a specific investment account that doesn’t

tax any of your gains from compound interest and is made explicitly for

retirement.

It’s an investing world

Gone

are the days where simply saving money in a bank account is good enough

for most people. With the rising wealth gaps, it’s not just salaries

that add to the difference but also that wealthier people are investing

and making money work for them. I know it’s tough when you’re struggling

to just make ends meet, but make it a goal and a mindset. $2 a day, $3 a

day, $5 a day, whatever you can do. It’ll get powerful. You start

analyzing your expenditures to make sure that you can save that amount

of money every day, no matter how small it is. It takes root and slowly

but surely it takes hold. Learn good financial habits, engrain them and

strive for your goals.

Take

away the image that to have a lot of money you need to make a lot of

money. People who make $200,000 a year but also spend $200,000 a year

don’t have money.

Trees don’t grow in a day, and neither does your money.

Originally published at www.savvysavior.com on February 17, 2019.

Comments

Post a Comment